Ideally, a power plant selects a turbine oil that provides long life, free of performance problems, clear indicators of when the fluid needs to be changed and is provided by a dependable, knowledgeable supplier. It is more difficult than it appears however to choose such a fluid.

Ideally, a power plant selects a turbine oil that provides long life, free of performance problems, clear indicators of when the fluid needs to be changed and is provided by a dependable, knowledgeable supplier. It is more difficult than it appears however to choose such a fluid.

The most common turbine oil selection criterion is not necessarily the best – Price. This mindset also considers turbine oils a maintenance expense – something that is accounted for on your profit and loss statement. We prefer to think of turbine oils as an asset. Possibly something that is accounted for on your balance sheet rather than your P&L statement. This is because turbine oils can last for years if properly maintained and conversely can cause significant costs to your operation if not cared for. Selecting the best turbine oil asset for your application can result in significant long-term savings for your plant.

All of the available turbine oils in the market meet the OEM specification or industry guidelines such as ASTM D4304 or DIN 51515. Most of today’s formulations are remarkably similar containing approximately 98-99% of a GII base stock, antioxidants and a few other additive components. This is where the similarities end however. In the field, we see a wide range of performance differences between various turbine oil types. We constantly hear about the delicate, synergistic blend of additive chemistries required to make a high quality product. Perhaps this isn’t just sales talk!

One of the reasons that we see such a variation in turbine oil performance in the field is due to the tests used to qualify a turbine oil. Or lack of tests. The current test slate required to meet most OEM & industry specs are not indicative of the performance of the fluid in the field. Oxidative stress tests such as the Rotating Pressure Vessel Oxidation Test (ASTM D943) or the Turbine Oil Stability Test (ASTM D943) do not have a relationship to the performance of a fluid in the field. For example, an oil may have an initial RPVOT value of 2500mins however may fail due to significant deposit formation upon its first six months of operation.

We’ve seen a positive trend towards developing new tests that are more indicative of turbine oil performance. These efforts may one day allow us to actually derive value out of a turbine oil spec sheet. MHI is an example of one OEM that has developed a challenging test criterion based on sludge formation that oils must pass before they are approved. International Standard bodies such as ASTM are also developing new tests. Recently, ASTM approved the Membrane Patch Colorimetry test (ASTM D-7843) which is designed to measure turbine oil varnish potential. I believe that tests such as this will find their way onto new oil test slates in the future and eventually be part of a new oil specification.

As counter-intuitive as it may seem, there is not a correlation between price and performance between different brands. There is one turbine oil on the market that is at least double the price of the average turbine oil and has shown to be a significant varnish producer in the field.

All turbine oils can perform better in the field if they are properly monitored and maintained. Conversely, the best turbine oil formulation will cause performance problems without proper maintenance. A key part of maintaining in-service turbine oils is knowledge and support. Therefore, having strong technical and customer support from your oil supplier is a valid criterion for selecting turbine oils. Most power plants are operating with fewer and fewer people, all of whom have greater responsibilities. Carefully selecting vendors based on their level of expertise and service can be a smart decision for some power plants.

Another valid selection criterion to consider is field experience. If you’ve had good success with your existing turbine oil formulation, it makes sense to stick with your current supplier. Message boards and user groups are another effective way of gathering additional performance feedback on different turbine oils.

We are supporters of generating your own turbine oil data to help you make more intelligent decisions. It’s quite easy to run some stress tests on new turbine oils and compare the results between different oils.

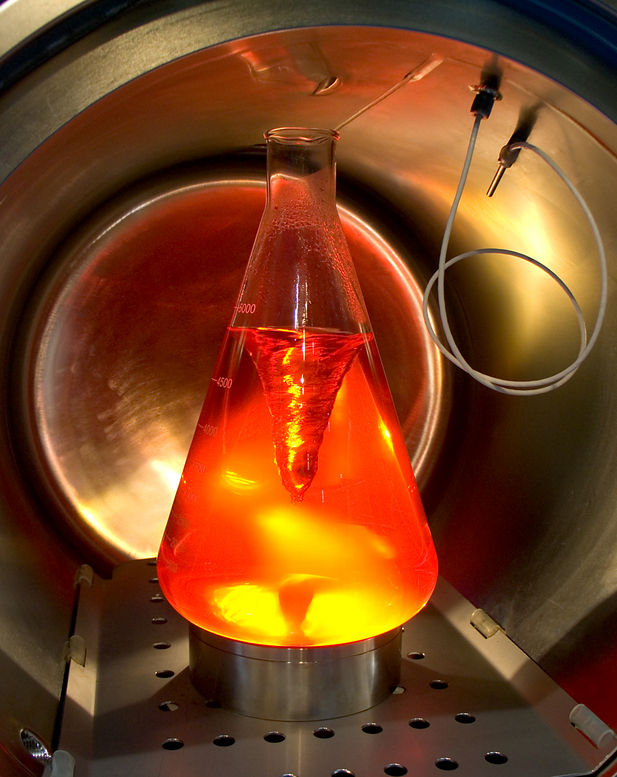

We’ve created the Turbine Oil Performance Prediction (TOPP) test to help users evaluate different formulations and to make better purchasing decisions. The purpose of the test is to stress new turbine oils in an accelerated way to measure any physical changes to the fluid. One of the most common failure modes of in-service turbine oils is deposit formation (sludge and varnish). The most common reason for changing a turbine oil is antioxidant depletion (sometimes measured as oxidative stability). Clearly, these are two important parameters to measure and compare in this stress test.

The TOPP stresses an oil at 120C with an iron catalyst for 4-6 weeks. Each week, tests are drawn to measure oxidation, antioxidant health and varnish potential. This is a cost-effective procedure which most labs can perform for you. We have seen a wide range of performance variances in the TOPP test and we have observed some correlation to field performance as well.

We were surprised when we first started performing this test to see such a wide range of performance differences. In one case, we tested a turbine oil which was touted to be “varnish-free” completely fall apart and generate a high amount of deposits during this test.

Should you run this test before you buy every batch of new turbine oil? Probably not. However, if you have a fleet of turbines and would like to collect some additional data to go into your selection process, this is a really powerful test to consider. But whatever your selection criteria for new turbine oil, please look beyond the spec sheet and the price of the product!

Question for you: What selection criteria do you find most useful when selecting a turbine oil?